There are over 19,000 non-profits registered in the state of Kentucky according to the Kentucky Nonprofit Network’s recent report. Each dollar that goes into these organization is a dollar that works to serve our commonwealth.

We are working to call attention to a potential easy savings for these tax exempt organizations due to billing errors on part of utility companies.

In the past two years alone, we have worked with nine Eastern Kentucky based non-profits to get $21,941+ in sales tax refunds from utility companies.

For example, Kentucky Power refunded the David School in Floyd County $9,275 and the Stinnett Community Center in Leslie County $2,474. Cumberland Valley refunded divisions of Meridzo Ministries over $1,600.

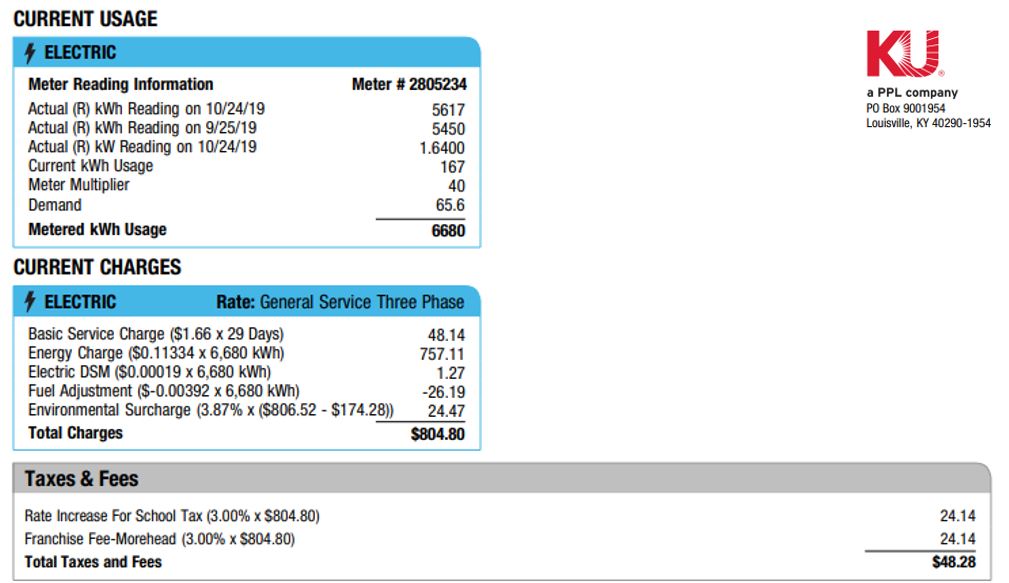

If you are a non-profit, you should check your utility bills to make sure you are not being charged sales tax.

There are a variety of reasons for these billing errors. For example, in some cases, non-profits will have moved into a building that was previously occupied by a for-profit business. The utility company does not realize that the new tenant is sales tax exempt and the tax is not removed when the utility service is transferred.

Depending on your utility, you may receive a credit for tax you have accidentally payed in the past. Kentucky Power will typically refund up to 3 years of sales tax, but many of the coop utilities have different refund policies.

MACED offers free utility bill reviews for Eastern Kentucky based non-profits, businesses, local governments, and more. We also offer free energy audits in many Eastern Kentucky counties. Apply for an audit here.

Please contact us if you would like to discuss a billing review, or if you need help contacting your utility company to have sales tax removed from your bill.