Lending

Expand your impact with our affordable loans.

Hemphill Community Center

Neon, KY

The Mountain Association finances businesses and organizations that are key to their Eastern Kentucky communities.

We are a Community Development Financial Institution and a nonprofit—not a bank. This means our loans can offer greater flexibility than those available with a traditional lender.

To go along with our loans, we also offer a number of other services to our clients. Our Business Support program can pay for all the costs of a consulting project for your business or organization – from marketing support to Quickbooks training, and more. Our Energy team can conduct a free energy audit of your building to help you find energy savings.

Whether you are just getting started with your business idea, or you are an established business or nonprofit needing a loan to expand your impact, we can find the right kind of affordable financing for you.

Details:

Loans range from $1,000 to over $1 million. Interest rates typically range from 5% to 7.75% with flexible terms. For loans specifically for solar installations, we offer 4% fixed interest with 20 year terms.

Decisions for loans under $50,000 are typically made within 2 to 10 business days, once we have all the information we need. Please learn more about our process in this three minute video or check out our FAQs.

We serve the 54 Appalachian counties in Kentucky.

“With access to a small loan and support, my business was able to stand on its feet. I am where I am today because of the Mountain Association.”

Cynthia Main

Sunhouse Craft

Berea, KY

Here are some things we consider:

- Vision & passion of the business owner

- Impact to the community

- Basic business plan with projections and/or historical financial information

- Capacity to repay the loan

- Collateral

- Guarantors

If you’re ready to start the loan process, please visit the link below. If you have questions or you are a current/former client wanting to apply for a new loan, please reach out to Yvonne Burchett, our Lending Associate, at yvonne@mtassociation.org or (606) 594-6540.

Frequently Asked Questions

Who does the Mountain Association serve?

The Mountain Association supports small business owners, nonprofit leaders and local governments with loans, as well as a variety of other services, including business support and energy services. We serve the 54 Appalachian counties of Kentucky, and we have offices in Berea, Prestonsburg, and Hazard.

Because we are a Community Development Financial Institution and a nonprofit – not a bank – we can lend to those who would not be able to get a business loan with a traditional lender. Unlike most lenders, we offer flexible payment schedules, and we can pay for all or a portion of a project to help your business or organization succeed – from website development to professional photography, and more. Our energy team can also help facilitate energy efficiency upgrades and renewable energy installations in order for you to save money on utility bills.

Does the Mountain Association provide grants or personal loans?

We do not offer grants or personal loans. We only provide loans for businesses or organizations.

What is a business loan?

A business loan is a legal agreement between a borrower and a lender, like the Mountain Association, to provide financial support for your business. The agreement states the amount of money you borrow, interest rate (or cost you’ll pay for borrowing the money), the term (or length of time you’ll have to pay the loan back) and the amount you’ll pay on a monthly basis.

What are your interest rates and terms? What are your collateral and guarantor requirements?

Interest rates vary, and are based on a risk and impact assessment of each loan as it’s considered. Our loans range from $1,000 to $1,000,000 and up. Interest rates typically range from 5 to 7.75% with flexible terms, depending on the loan purpose, amount and type of business. Please note: for loans specifically for solar installations, we offer 4% fixed interest with up to a 20 year term. For loans for energy efficiency upgrades, like a new HVAC for example, we can offer 5% fixed interest.

Terms range from one to 20 years, depending on loan purpose and collateral type.

Loans typically require collateral, which is what you will pledge in the event you are unable to repay the loan. For example, this could include a building you own, a car you have, a piece of property, or a large piece of equipment. We need collateral to give us the assurance we can get the loan money back in the unfortunate event you are unable to repay the loan.

Loans also typically require personal guarantors. A guarantor is a person or entity that assumes the financial obligation of another party in the event that the original party is unable to repay a loan.

What are your fees?

There are administrative closing fees based on the loan size. For example, loans $50,000 or less are 2% of the loan amount, while loans over $50,000 are typically 1.5% of the loan amount. Depending on what your collateral is, you may have additional fees, such as Uniform Commercial Code (UCC) filings, mortgage filing, appraisal fee, equipment evaluations, title liens, etc. The majority of the fees are rolled into the loan amount.

What factors do you consider when deciding whether or not to make a loan?

We consider the community impact of your idea, capacity to repay the loan, experience of the entrepreneur, credit history of the owners (please don’t let a low credit score deter you from applying- see below for more details!), and purpose of the loan. If the business is just getting started, we consider the business idea. If the business is an existing business, we consider the business history.

What documentation will I need to provide for the loan process?

The documentation you need to provide will depend on whether you have an existing business or are starting a new business, and the total amount requested. Typically, the below lists are what we will need.

Please don’t worry if you do not have these things ready. We can go ahead and get started on your request while you work on the other items.

Existing business loan request under $50,000:

- Business Tax Returns – for each of the last 3 years, if any

- Business Income/Expense Statement & Balance Sheet – for the current year-to-date, if any

- Personal Tax Returns – for the last 2 years from each business owner listed

- Other Information – our staff may ask for additional information depending on your application

New business loan request under $50,000:

- Business Plan – if no tax returns for the last 2 years

- Business Financial Projections – if no tax returns for the last 2 years

- Personal Tax Returns – for the last 2 years from each business owner listed

- Other Information – our staff may ask for additional information depending on your application

Existing business loan request greater than $50,000:

- Business Tax Returns – for each of the last 3 years, if any

- Business Income/Expense Statement & Balance Sheet – for the current year-to-date, if any

- Personal Tax Returns – for the last 2 years from each business owner listed

- Personal Financial Statement – current within the past 3 months from each business owner listed

- Business Debt Schedule – current within the past 3 months

- Other Information – our staff may ask for additional information depending on your application

New business loan request greater than $50,000:

- Business Plan – if no tax returns for the last 2 years

- Business Financial Projections – if no tax returns for the last 2 years

- Personal Tax Returns – for the last 2 years from each business owner listed

- Personal Financial Statement – current within the past 3 months from each business owner listed

- Other Information – our staff may ask for additional information depending on your application

If I have a low credit score, can I get a loan from the Mountain Association?

Many of our borrowers have credit scores that disqualify them from getting a traditional bank loan. We look at a variety of factors when deciding on a loan. Though we consider credit history, we also consider your experience as a business owner or entrepreneur, community impact, what you are investing in the business, the business’ financials (if an existing business) and projections, purpose of the loan, and risk.

Additionally, because our loans are to a business or organization, your personal credit will not be impacted (beyond one hard credit pull) by a loan the Mountain Association.

Learn more about improving your credit score here.

Note: We have a loan option for using your ability to crowdfund as the main criteria for approval. Through these “CrowdMatch Loans,” a credit check is not required.

How do loan disbursements work after I am approved?

Once your loan is approved and closed, disbursements can begin. The way we disburse funds for our loan clients also looks a little different than at a bank. For example, for most of our loan clients who need to make a large equipment purchase, we would typically issue payment directly to the vendor. Similarly, for purchase of real estate, we would typically issue payment directly to the seller.

For smaller purchases, the loan client sends us receipts and we reimburse. This is usually more beneficial to a borrower because they won’t be making payments on the full amount of a loan, but rather just the amount that they have used up to that point.

Though we do offer working capital loans, we typically structure our loans to include direct vendor payments in order to have greater accountability to our funders on where funds are used.

I think I’m ready to apply. What will I need to provide?

The information we need varies depending on the size of the loan and the length of time the business has existed.

For businesses that are just getting started, we will need a business plan and basic financial projections. If you do not have a business plan, please find resources here to learn how to create one. If you do not have financial projections, please find a template here via Initiate, a free online platform Mountain Association provides access to.

For existing businesses, we often need financials and personal income tax statements for the last three years.

This short video provides more details on the above items and what else you will need to provide during the loan application process: https://www.youtube.com/watch?v=eVjvFrdMPeM

Please contact a staff member with any questions.

What is the timeframe for approval of loans?

Once we have all the information we need, decisions for loans under $50,000 are typically made within 2-10 business days. Larger loans have a longer processing time as loans larger than $50,000 must be approved by our loan committee. For these larger loans, after we have received your application and all of the necessary information, a staff member will create the loan proposal and present it to the committee. The committee generally meets monthly. It can take up to as long as six weeks to get an answer on an approval or denial for these larger loans.

As a nonprofit, why do you charge an interest rate?

We charge an interest rate to help cover our costs, which can include individual coaching and consulting to clients, salaries, overhead, and the interest we must pay on the borrowed money that we re-lend.

I have never applied for a business loan and am just getting started with my idea. How do I find other resources for learning?

This short video provides more details on start-up business loans and tips on what you should do before you apply: https://www.youtube.com/watch?v=eVjvFrdMPeM

You can also find more resources on our Business Support page for tips on starting your business.

In addition to our standard loans and SBA loans, we offer specialty loans:

Emergencies

Emergency Loans

Eligible businesses & organizations can apply for an emergency loan from Mountain Association:

- Amount: $1,000 to $5,000

- Interest Rate: 3%

- Interest Only for first 12 months

- Term: Up to 5 years

- No application fee, no closing costs, no collateral, no personal guaranty

These loans are available to businesses and nonprofits that have experienced an emergency, such as essential equipment breaking down, damage from floods, heavy winds, or fire, etc.

Flooding/Disaster

Recovery Loans

We have a new loan, long-term loan option for eligible businesses & organizations impacted by flooding or other natural disasters:

- Amount: $1,000 to $100,000+

- Interest Rate: 0% for the first 12 months and then 3.75% if directly impacted; 0% the first six months and then 3.75% if indirectly impacted by disaster

- Minimal principal payments of $1 per $1,000 (For example, if the loan is for $10,000, principal payment for the 0% interest period will be $10)

- Term: Fixed rate up to 10 years

- Collateral options are flexible

- No origination fees and no prepayment penalties

CrowdFunding

CrowdMatch Loans

Crowdfunding is a non-traditional approach to raise funds for new ideas. It gives you a platform to build, showcase and pitch your new idea to friends, family, customers and potential investors. Many great ideas are supported by crowdfunding, but sometimes those funds are not enough to start a business.

The Mountain Association’s CrowdMatch loan can help you fill in the gap. We will match dollar for dollar – up to $10,000- the amount you raise through crowdfunding, with no credit check for eligible enterprises.

Efficiency & Solar

Energy Savings & Solar Loans

Whether it’s LED lighting, new HVAC, or insulation, investing in energy upgrades lowers your overhead costs, letting you put more money into your bottom line, your mission, or your community. Our energy team can help you determine what steps you need to take to save money. And if the up-front costs for upgrades are too high, our microloan is an option for eligible businesses and organizations.

The monthly payment is generally equal to or less than the savings on your bill – this means you get the benefits of energy savings without any additional out-of-pocket expense!

- Amount: $1,000 to $50,000

- Interest Rate: 5%

- Term: Fixed rate up to 72 months

Please note, these terms are for energy efficiency related items only. We continue to offer our 4% solar loans, outlined here.

Success Stories

Learn how folks are starting, expanding, and improving their small businesses and organizations through our flexible loans.

From Employee to Owner: Steve and Heather Johnson’s Journey at Top Drawer Gallery

Read From Employee to Owner: Steve and Heather Johnson’s Journey at Top Drawer Gallery

From Boarded Up to Bustling: Another Hazard, KY Building Renovated

Read From Boarded Up to Bustling: Another Hazard, KY Building Renovated

Raising Dough: The Crowdfunding Journey Behind Native Bagel

Read Raising Dough: The Crowdfunding Journey Behind Native Bagel

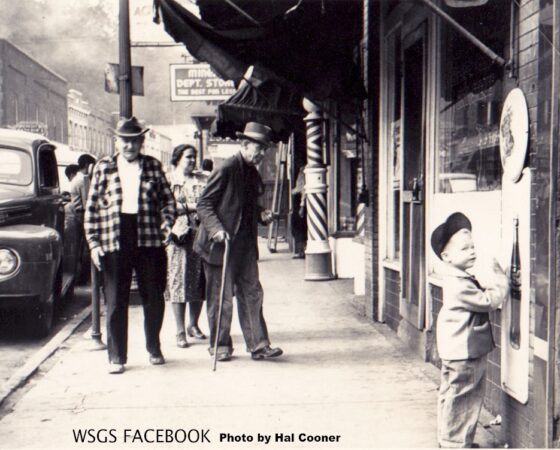

Downtown Hazard’s New Barber on Main Street

How Trauma & Financial History Can Impact Aspiring Business Owners

Read How Trauma & Financial History Can Impact Aspiring Business Owners

Preparing for a Loan

.

.

.

We are a SBA lender. Funded in part through a Cooperative Agreement with the U.S. Small Business Administration.

The Mountain Association is an equal opportunity provider, employer and lender.

In accordance with federal laws and U.S. Department of the Treasury policy,

this organization is prohibited from discriminating on the basis of race,

color, national origin, sex, age, or disability. To file a complaint of

discrimination, write to: U.S. Department of the Treasury, Director, Office

of Civil Rights and Equal Employment Opportunity 1500 Pennsylvania Avenue,

N.W., Washington, DC 20220; call (202) 622-1160; or send an e-mail to:

crcomplaints@treasury.gov